The central bank is liable for the liquidity in the financial system of the county. Inflation is mainly caused either by demand Pull factors or Cost-Push factorsApart from demand and supply factors Inflation sometimes is also caused by structural bottlenecks and policies of the government and the central banks.

Inflation Targeting What Rule For The Central Bank Of West African States Bceao Cairn International Edition

14 The major objective of the European Central Bank is to ________.

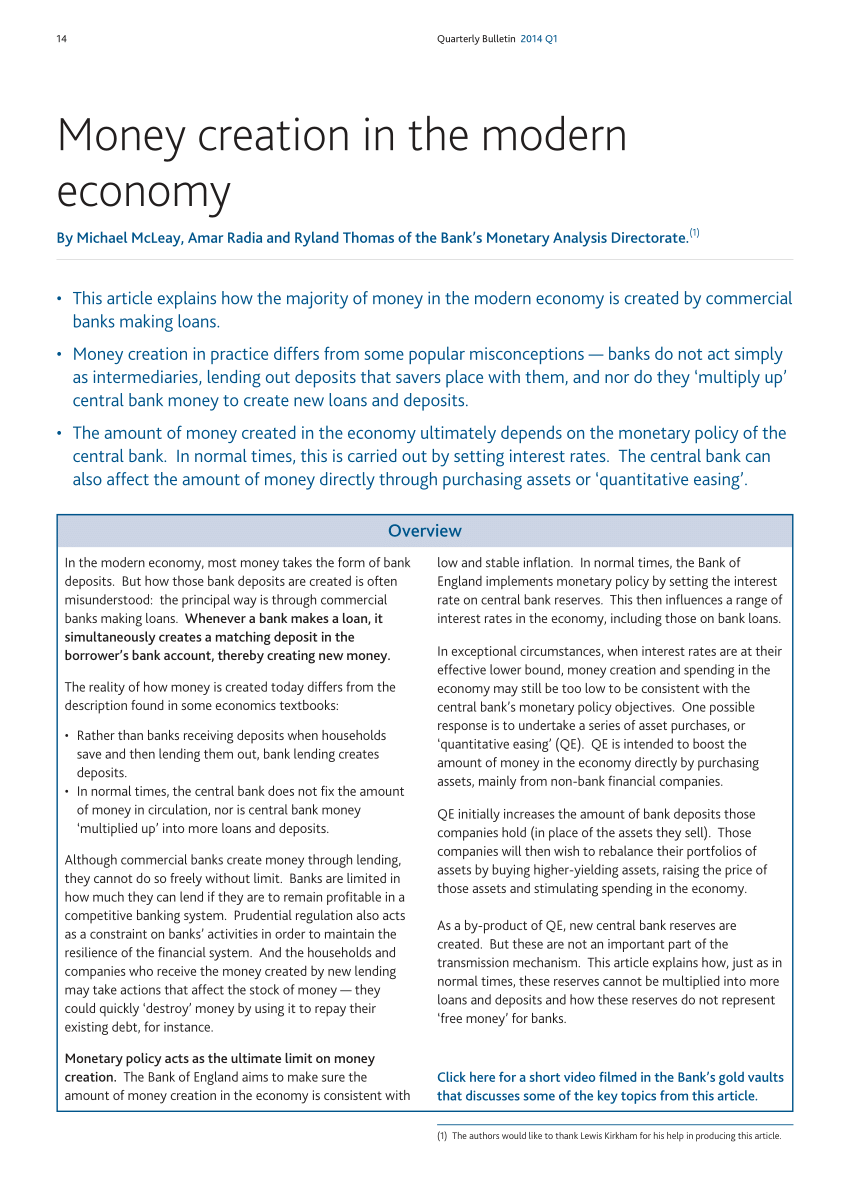

. The central bank buys and sells securities with. When inflation is ____ the Fed aims to slow the economy. Many central banks have since adopted explicit inflation targets.

Which best describes a central banks primary role. They buy and sell large quantities of foreign currency to affect supply and demand. Nurs 5366 Nurs5366 Test 5 Questions And Answers 100 In 2022 Standard Deviation Question And Answer Type I.

The primary role of the central bank is to create a monetary policy. In addition to that the central bank is instrumental in formulation of monetary and fiscal policies that help in regulation of money in the market and controlling inflation. It affects banks stability.

It is a practice of the commercial banks of a country to keep a part of their cash balances in the form of deposits with the central bank. Controlling inflation increasing credit printing money creating monetary policy Creating monetary policy best describes a central banks primary role. The disinflation route sometimes immolates economic growth and employment.

The first is to maintain maximum employment and the second is the keep prices stable while and long-term interest rates. In the US for example the Federal Open Market Committee targets the federal funds rate. To move inflation toward the target central banks typically rely on an overnight nominal interest rate.

A set monetary policy for EU countries that adopt the euro B ensure that EU interest rates are equal to US. Controlling inflation increasing credit printing money creating monetary policy Creating monetary policy best describes a central banks primary role. Rates C control taxes as a means of monitoring EU debt D reduce spending by EU.

Historically the anti inflation objective of central bank had created an inflationary bias. Most central banks produce regular economic statistics to guide fiscal policy decisions. The central bank has three monetary tools.

Conventional central banking practice is to increase the nominal interest rate target when. It is the amount of cash that should be held by each commercial bank. Custodian of Cash reserves.

Money is a commonly accepted medium of exchange. The Federal Reserves two mandates were shaped in the 1970s. 2 on a question Which best describes a central banks primary role.

Which best describes what a central bank uses monetary policy to do. Money is the most liquid it is easy to sell in the market like gold silver etc of all assets in the sense that it is universally acceptable and hence can be exchanged for other commodities very easily. Important Questions on Economics Topic 9 Inflation.

UPSC IAS Prelims 2022. When the Fed adjusts its interest rate it directly influences consumer. Monetary policy involves decreasing the money supply.

The methods central banks use to control the quantity of money vary depending on the economic situation and power of the central bank. Steer the economy away from recession and toward growth. In the United States the central bank is the Federal Reserve.

Central bank around the world n general i has the main objective of maintaining price stability which is represented by inflation. Lender of the last resort to prevent financial crisis. Central banks also regulate exchange rates as a way to control inflation.

Money is anything that can be generally accepted as payment for goods and services or settlement of debts. The _______ loan interest rate is the interest rate banks charge each other for borrowing or storing money.

Omnichannel Banking Consumers Are Looking For Personalized Services Through Different Channels Banking Digital Strategy Disruptive Technology

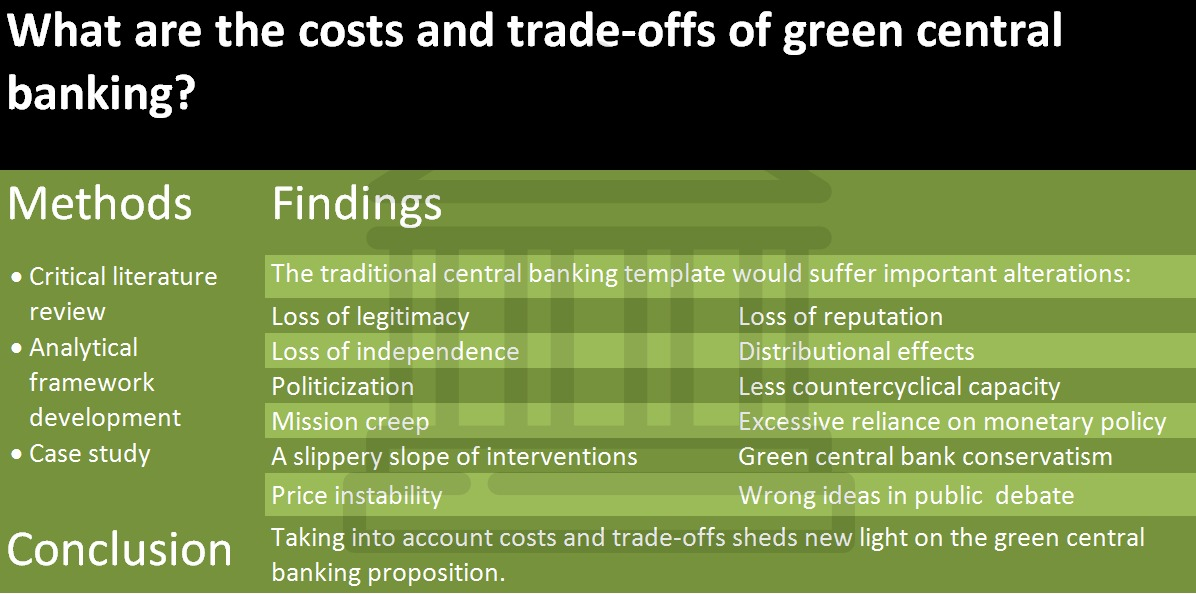

Energies Free Full Text The Costs And Trade Offs Of Green Central Banking A Framework For Analysis Html

0 Comments